Zambia and DRC Climb High

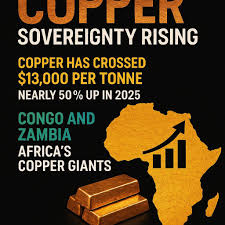

Copper’s record surge has handed Zambia and the Democratic Republic of Congo an opportunity of a lifetime.

The neighbors are far and away Africa’s biggest producers of the metal, which generates the bulk of their exports and a big slice of government revenue. Prices have jumped almost 50% since the start of 2025 and this year smashed through $13,000 a ton for the first time, providing a significant boost to the countries’ finances.

Trump’s Interest

Concerns that President Donald Trump’s administration may introduce tariffs on refined copper, which is used in wires and cables, have triggered a rush in shipments to the US. America holds about half of global inventories of the metal, according to Swiss bank UBS.

“Inventories used to act as a buffer, but now they’re locked in the US,” said Li Xuezhi, head of research at Chaos Ternary Futures. “So the buffer is gone and everyone will have to scramble.”

Congo’s Tripled Production

Congo’s copper production has tripled over the past decade following a surge in investment, making it the world’s biggest supplier after Chile. Zambia aims to replicate that success and more than triple its output by the early 2030s.

Optimism is running high that copper’s rally has some way to go, with traders anticipating greater demand from high-growth sectors like renewable energy, data centers and power grids. Supply will also be constrained by underinvestment in new mines and disruptions at existing operations.

Investors are taking note. Congo’s franc gained almost 28% against the dollar last year, while Zambia’s kwacha advanced 26% and yields on its dollar bonds fell to record lows.

The challenge confronting the governments of both nations will be to put any additional revenue to good use and ensure citizens benefit fully from the opportunities afforded by their growing importance in a swiftly reordering global economy. — William Clowes

In summary

Copper Surges to Fresh Record as Inventories ‘Locked in the US’

Copper Lifts Zambia’s Kwacha as Africa Gains From Metals Rally

US Vows Over $1 Billion for Congo Critical Minerals Supply Chain

How a Copper Crunch Is Looming Just as AI Boom Hits: QuickTake

Hot Metals Are Exposing the Fossil Fuel Fantasy: David Fickling

Source: Bloomberg NEXT AFRICA

Pg 1

EnterpriseIssues

With Siaka Momoh

From the Archives

Hospitality: The Future is Now

‘It’s not your customers’ job to remember you, it is your obligation and responsibility to make sure they don’t have the chance to forget you’ – Patricia Fripp

SIAKA MOMOH

It is expected that the hospitality sector in Nigeria will record slow growth in 2021. Hotels that would remain relevant in 2021 and the future would need to adapt to their business operations in companionship with new trends and the emerging hydraulics of the industry, a recent research by Proshare Nigeria Limited has revealed.

The Proshare research says, for example, “hoteliers who are interested in maintaining and attracting new customers would need to emphasize safety and hygiene in their operations”. “Furthermore, they should have sufficient knowledge of trends in which customers would be interested to guarantee their feel and comfort in the hotel’s environment e.g., virtual reality tours, mobile check-in service, etc”

Hotels: Planning a Recovery

It says “Most hotels in Nigeria recorded declines in their profit in 2020 as the effect of the coronavirus pandemic took its toll on their profit and loss accounts and statements of financial positions. Therefore, most hotels would be concerned with the task of engineering a recovery in 2021 amidst uncertainty.”

The research goes on to state that some strategies that could be adopted by hoteliers include adopting flexible pricing strategies with guiding rates, pair flexible cancellations with options to rebook, evolve operating procedures to address health and safety concerns from both staff and guests, re-evaluate core customer segments, feeder markets, etc.

It states further: “The coronavirus pandemic has necessitated the need for hotels to re-evaluate core customer segments to guide their decision-making and marketing strategies. Hotels need to understand how far their guests travel from and how long it takes for them to arrive at their destination and their purchasing power ability and how it has been affected by the pandemic. Also, it is important to understand the demographic characteristics of guests to understand if they are locals, regionals, or international guests, which language do they speak? etc. Understanding travel purposes makes it easier to strategize and appeal to core customer feelings and service experiences. This is so because customers who travel for leisure would have different expectations from those who travel for business.”

The Proshare research argues: “ An automated marketing campaign strategy would help hotels navigate through the year 2021 citing the website, hospitalitynet.org as saying hotels can ‘develop an automated marketing campaign for the anniversary of past guests’ stay, prompting them to come back and relive the memories, develop an automated marketing campaign for past guests’ birthdays with an exclusive package or complementary offering, develop automated marketing campaigns around loyalty status offering ongoing perks and inviting members to come back and stay, and set up an online travel agency bounce-back campaign, prompting those who have booked through online travel agencies to book through the direct website’”.

For Proshare: “Evolving operating procedures to address health and safety concerns of both staff and guests by hotels will help restore customer’s confidence and trigger a rebound in the sector. Winning the confidence of customers would require a thoughtful examination of current business processes to prioritize the wellness of staff and guests through social distancing and sanitization while maintaining the core of the experience customers know and love.”

Proshare Nigeria Limited, founded on December 20, 2006, is a niche financial information service hub with a key focus on delivering market intelligence, data, analysis/analytics, research and news on markets, business, technology, regulation, MSME, personal finance and economic development.

NB

This is a throwback story sourced from Archives Siaka-Momoh. We will appreciate your sincere comments on this piece. WE believe your comments will help to enlarge knowledge and business in the hospitality business space.