Crossing above 1.4 trillion naira Fund Under Management within 10 years of establishment, and maintaining dominance as the leading Pension Fund Administrator (PFA) for two consecutive years, with the highest returns on investment across the four funds, NPF Pensions Limited has maintained a trajectory of growth.

With 38 per cent return on Investment in 2024 outperforming the 34 per cent inflationary rate, the Management of NPF Pensions is poised to sustaining its excellent performance by delivering world class customer service experience and impressive returns to its stakeholders.

According to statistics on sterling performances of NPF Pensions published by Nairametrics for January to December 2024, NPF Pensions had an impressive performance.

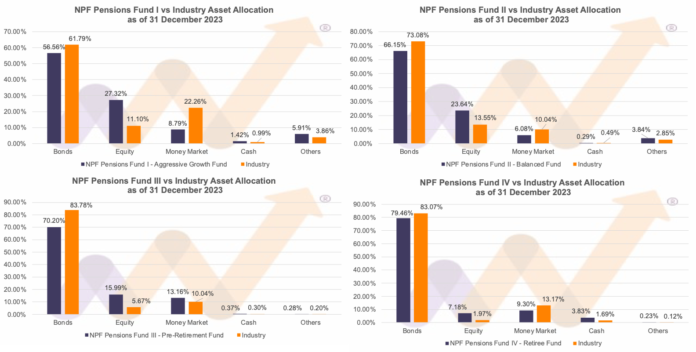

According to the Fund One category, NPF Pensions emerged as the clear leader, delivering an impressive 38.87% return.

This performance placed it significantly ahead of other PFAs, setting the benchmark for exceptional fund management in 2024.

In Fund Two category, which is the default fund accounting for a reasonably good percentage of subscribers under the Contributory Pensions Scheme, NPF Pensions also led the pack with an impressive return of 31.56%, significantly outperforming the average and setting a high benchmark for the year.

In Fund Three category, NPF Pensions again emerged as the standout performer with a return of 30.68%, far exceeding the fund group average and setting a high benchmark for the year.

Also, under Fund Four (Retirees Fund), NPF Pensions again led the funds with a return of 18.05%, significantly outperforming the average and demonstrating strong investment management tailored for retirees.

This performance, according to the Managing Director of NPF Pensions, Dr Kolade Morakinyo in a chat with newsmen, was made possible with the support of the Inspector General of Police, IGP Kayode Egbetokun and the hard work of the dedicated staff of the company who worked round the clock to ensure that we achieved our targets.

According to him the company has continued to enjoy the support of its major stakeholders the Police institutions under the able leadership of IGP Kayode Egbekokun who wants the best for the officers of the Nigeria Police Force. He is very passionate about the company because he wants the officers to retire with smiles on their faces and he has done everything possible to see this happen.

However, this growth trajectory may have been momentarily slowed down by the prevailing equity repricing in non banking and highly capitalized equities in the Nigerian stock market.

Expectedly,the impacts of the equity repricing which is largely determined by the level of exposure to non-banking and highly capitalised equity affected the performance of players in the nation’s Stock Market.

Against the above background, the management of NPF Pensions has reiterated its commitment to ensuring that its growth trajectory which has earned it an enviable position as one of the top tier PFAs would be maintained.

This would be by leveraging on its investment strategy which is structured towards long-term capital gains.