Enterprise Issues

With Siaka Momoh

Daily Times was, in years past, Nigeria’s newspaper of note. When parents wanted to access the news for the day, they asked their wards to buy them Daily Times even when what they wanted was Tribune, Sketch or New Nigeria. As big and popular as the newspaper was then, it fell like a pack of cards. To date, this Nigeria’s number one newspaper is a shadow of its old self.

Concord newspaper group was a household name. It even ventured into community newspapering but died with the death of the hero of June 12 Chief Mushood Kashimawo Abiola.

We also had the likes of Jamarkani Transport, Oni & Sons (a construction company), and a chain of retail outlets like Kingsway Stores, UTC, Leventis Stores etc. They all died.

It is on record that several cocoa processing companies in Nigeria have failed or struggled due to crippling debt, lack of working capital, stiff export hurdles from government policies (like non-endorsement of EPAs), and foreign partner issues, with Multi-Trex Integrated Foods PLC and FTN Cocoa Processors PLC being prominent examples that faced massive closures and financial crises, impacting over 84,000 jobs and leaving machinery to rot.

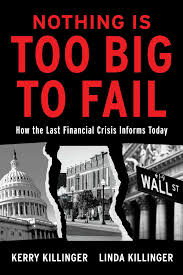

Big corporates in industrialised countries have had their own share of collapses too. We have heard about troubled Lehman Brothers, Enron, AIG, Royal Bank of Scotland Group. We have reports of ABC Learning Centres (childcare business) whose founder Eddy Groves had a pretty good little business going in Australia – profitable, fast growing and underpinned by government childcare subsidies. But his forays into the US and British markets distracted Groves from the day-to-day running of the Australian business, and without his scrutiny the low-margin operations started losing money. Eddy’s ambition of creating a global childcare giant was his undoing – had he stayed focused, ABC’s fate could have been very different.

Allco Finance Group, like fellow fallen finance groups such as MFS, Allco’s problem was simple – too much debt. Add this to a business model that was insanely complex and you have a recipe for disaster.

Only recently, Reuters had this troubling report on Peabody Energy Corp:

Leading global coal producer Peabody Energy Corp filed for U.S. bankruptcy protection after a sharp drop in coal prices left it unable to service debt of $10.1 billion, much of it incurred for an expansion into Australia.

The Chapter 11 bankruptcy filing from Peabody, the world’s biggest private-sector coal producer, ranks among the largest in the commodities sector since energy and metal prices began to fall in mid-2014 as once fast-growing markets including China and Brazil started to slow.

Unlike most large corporate bankruptcies, Peabody’s filing did not sketch out a plan for cutting debt, although it said it expected its mines to continue to operate as usual.

Peabody estimated its assets at $11.0 billion and liabilities at $10.1 billion as of the end of 2015, according to court documents.

The St. Louis-based company said its planned sale of mines in New Mexico and Colorado had fallen through and that its Australian operations were excluded from the bankruptcy filing.

Peabody agreed to $800 million in debtor-in-possession financing from both secured and unsecured creditors, subject to court approval, including a $500 million term loan, a $200 million bonding accommodation facility for cleanup costs and a letter of credit worth $100 million, it said.

Large coal companies like Peabody have been allowed to leave a share of future mine cleanup without collateral through a programme called “self bonding” that has come under federal scrutiny following financial distress in the coal sector.

Shares of Peabody, which closed at $2.07 on a Tuesday, were halted on Wednesday.

“This process enables us to strengthen liquidity and reduce debt, build upon the significant operational achievements we’ve made in recent years and lay the foundation for long-term stability and success in the future,” Peabody Chief Executive Officer Glenn Kellow said in a statement.

Ill-timed acquisition

Debt troubles for Peabody date to its $5.1 billion leveraged buyout of Macarthur Coal in 2011, just when prices peaked for the metallurgical coal that the Australian company supplies to Asian steel mills.

As demand for metallurgical coal fell, particularly in China, Peabody’s financial woes intensified. The company took a $700 million write-down on its Australian metallurgical coal assets last year.

This is a lesson for businesses on our shores – small and big.